Performance of all PFAs in Nigeria for January to July 2023 (Year to Date)

The performance of all Pension Fund Administrators (PFAs) in Nigeria for January to July 2023, for Fund I, II, III and IV, was GREEN for all PFAs in Nigeria, i.e no PFA had a negative return on investment for the period under review.

Industry average Return on Investment (ROI) for January to July 2023

The industry average Return on Investment (ROI) per fund shows the average performance of all PFAs in Nigeria for Fund I, II, III and IV for January to July 2023.

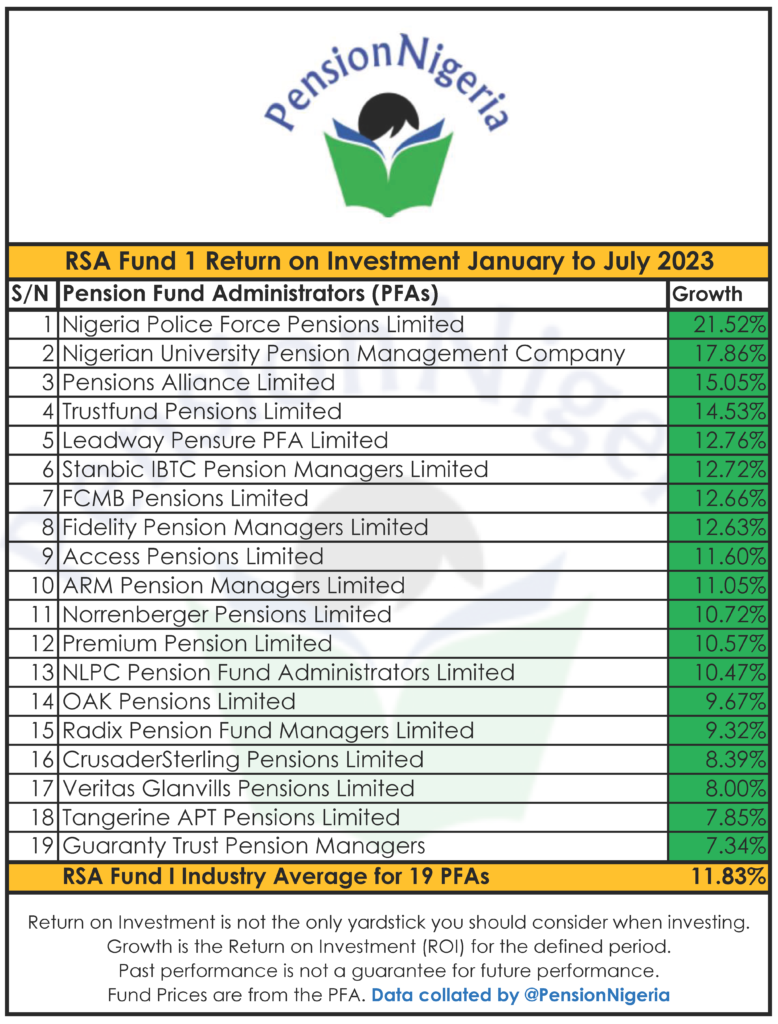

RSA Fund I Industry Average for 19 PFAs 11.83%

RSA Fund II Industry Average for 19 PFAs 10.00%

RSA Fund III Industry Average for 19 PFAs 8.35%

Retiree Fund IV Industry Average for 19 PFAs 7.00%

Support PensionNigeria financially with N1,000 per Month HERE, or with any amount HERE

Empower us to do more independent analysis of the Pension Industry in Nigeria

Subscribe to PensionNigeria Daily News Broadcast on WhatsApp, just send “Subscribe” to 08160052802, PLEASE ensure you also save 08160052802 to your contacts as “PensionNigeria” to enable you receive the PensionNigeria News Broadcast.

PFAs that appeared most in Top 5 PFAs based on Return on Investment (ROI)

The analysis below shows the number of times a PFA appeared in Top 5 PFAs for Fund 1, 2, 3 & 4, based on Return on Investment (ROI) for the four (4) Funds, for January to July 2023.

PFAs that appeared Top 5 in 4 Funds for January to July 2023;

Nigeria Police Force Pensions Limited

Pensions Alliance Limited

PFAs that appeared Top 5 in 3 Funds for January to July 2023;

CrusaderSterling Pensions Limited

PFAs that appeared Top 5 in 2 Funds for January to July 2023;

Leadway Pensure PFA Limited

Access Pensions Limited

PFAs that appeared Top 5 in 1 Fund for January to July 2023;

Nigerian University Pension Management Company

Trustfund Pensions Limited

Tangerine APT Pensions Limited

Radix Pension Fund Managers Limited

Norrenberger Pensions Limited

Top 5 PFAs based on Return on Investment (ROI) for each Fund

The table below shows the Top 5 PFAs based on Return on Investment (ROI) for each Fund, for January to July 2023, with the percentage increase for each PFA.

Support PensionNigeria financially with N1,000 per Month HERE, or with any amount HERE

Empower us to do more independent analysis of the Pension Industry in Nigeria

Subscribe to PensionNigeria Daily News Broadcast on WhatsApp, just send “Subscribe” to 08160052802, PLEASE ensure you also save 08160052802 to your contacts as “PensionNigeria” to enable you receive the PensionNigeria News Broadcast.

PFAs based on average Return on Investment (ROI) per PFA

The table below shows all PFAs based on the average Return on Investment (ROI) for each PFA, for Fund 1, 2, 3 & 4, for January to July 2023. This is the best performance monitoring tool for each PFA based on ROI, because it shows each PFAs’ average performance for the four funds for the period under review.

PFA Performance per Fund

Also below are the performance of all PFAs per fund for January to July 2023.

Fund 1 is a special but optional Fund that Retirement Savings Account (RSA) holders who are below 50 years old can request to be moved to. It has the highest exposure to stock among the Funds under the Multifund structure, meaning that a higher percentage of Fund 1 is invested in buying shares of companies compared to other funds. If you have requested to be moved to Fund 1, you should pay particular attention to the performance of Fund 1 but also constantly have a look at the performance of Fund 2 to be sure you made a right choice moving to Fund 1.

Fund 2 is the default fund under the Multifund structure for RSA holders who are below 50 years old. Multifund structure gives these RSA holders the right to request to be moved to Fund 1 if they choose to. The maximum equity exposure for Fund 2 is 25%. If you are below 50 years old, you should pay particular attention to the performance of Fund 2 but you should also monitor the performance of Fund 1 to assist you in deciding whether to move to Fund 1 or not. Any RSA holder below 50 years old who has not requested specifically to be moved to Fund 1, will be in Fund 2.

Fund 3 is the default Fund for RSA holders who are 50 years old and above but have not retired. Multifund structure gives PFAs the right to move these RSA holders who were in Fund 2 before the Multifund structure, to Fund 3, but the RSA holders can request to be moved back to Fund 2, if they choose to. Maximum Equity Exposure for Fund 3 is 10%. If you are 50 years & above and you have not requested to be moved back to Fund 2, then you will be in Fund 3. You should pay attention to the performance of Fund 3 and keep an eye on the performance of Fund 2 to enable you decide whether to move back to Fund 2.

Fund IV, this is the Retiree Fund. All RSA holders that have retired are automatically moved to Fund 4 and Retirees can not move to other Funds. Fund 4 has the lowest Equity Exposure of 5%.

Support PensionNigeria financially with N1,000 per Month HERE, or with any amount HERE

Empower us to do more independent analysis of the Pension Industry in Nigeria

Subscribe to PensionNigeria Daily News Broadcast on WhatsApp, just send “Subscribe” to 08160052802, PLEASE ensure you also save 08160052802 to your contacts as “PensionNigeria” to enable you receive the PensionNigeria News Broadcast.

Also Check out

Performance of all PFAs in Nigeria for January to March 2024 (Year to Date)

Performance of all PFAs in Nigeria for Full Year 2023

Performance of all PFAs in Nigeria for Full Year 2022

Performance of all PFAs in Nigeria for Full Year 2021

Performance of all PFAs in Nigeria for Full Year 2020

Performance of all PFAs in Nigeria for Full Year 2019

Performance of all PFAs in Nigeria for Full Year 2018

RSA Fund 1 Performance for 4 Years for all PFAs in Nigeria

RSA Fund 2 Performance for 4 Years for all PFAs in Nigeria

RSA Fund 3 Performance for 4 Years for all PFAs in Nigeria

RSA Retiree Fund (Fund 4) Performance for 4 Years for all PFAs in Nigeria

4 Years Performance for all PFAs in Nigeria

RSA Fund 1 Performance for 4&half Years (Inception to 31 December 2022) for all PFAs in Nigeria

RSA Fund 2 Performance for 6 Years (31 Dec 2016 to 31 Dec 2022) for all PFAs in Nigeria

RSA Fund 3 Performance for 4&half Years (Inception to 31 December 2022) for all PFAs in Nigeria

RSA Fund 4 Performance for 6 Years (31 Dec 2016 to 31 Dec 2022) for all PFAs in Nigeria

PenCom RSA Fund 1 (2018-19), Fund 2 (2016-19), Fund 3 (2018-19), & Fund 4 (2016-19) Performance for all PFAs in Nigeria

PenCom vs PensionNigeria Report on Return on Investment for all PFAs in Nigeria

Do you want to know more about the MultiFund Structure, check out our MultiFund Structure Executive Summary here

PensionNigeria monitors the performance of Fund I, II, III, IV & V, for all PFAs in Nigeria Check them out here

Support PensionNigeria financially with N1,000 per Month HERE, or with any amount HERE

Empower us to do more independent analysis of the Pension Industry in Nigeria

Subscribe to PensionNigeria Daily News Broadcast on WhatsApp, just send “Subscribe” to 08160052802, PLEASE ensure you also save 08160052802 to your contacts as “PensionNigeria” to enable you receive the PensionNigeria News Broadcast.

Subscribe to PensionNigeria Daily Newsletter and get Today’s Top Pension News delivered straight into your email box every Evening.

If you have subscribed before and you still do not receive our Newsletter, please check your “Spam Folder”, if you find our Newsletter there, mark it as “NOT SPAM” or move it to your Inbox

Pension is Your Right,

An Insurance for Old Age

Follow PensionNigeria on Social Media LinkedIn Twitter Instagram Facebook YouTube

Pingback: PensionNigeria Weekly Newsletter for Week Ended 30 September 2023 – PensionNigeria